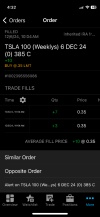

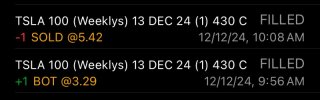

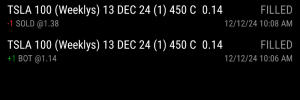

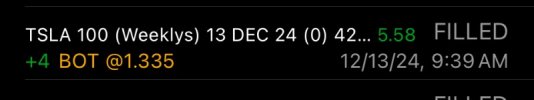

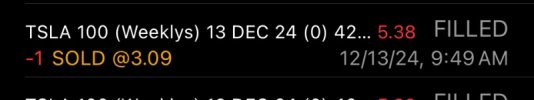

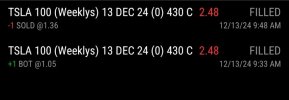

Do you like to think about it in minutes from buy to sell? (see below)

How long did you work the lead-in?

is it stock specific, or pattern recognition? Screener?

Did your post-analysis have you selling at a good spot (within 10% of the high? 20%?) -

I see your note about holding for more, but hitting the top is a crapshoot in every scenario.

To your point, you don't want it to be gambling - which, the point of picking when to leave is critical.

Think of this as me learning from you, and how I would learn from the actions. Not critical, just curious.

Cause certainly you could simulate it, but since it is real money, it has your real thinking/hesitation/risk management involved. target.