OK - since you challenged me, I went back and read it.

WRT the line about losing, i'm glad you put that in - cause most people leave that part out - just like the great horse racing handicappers

that make more money selling their opinion than they do at the track.

Here is my take on what you said - let's start with you and how you mentioned emotions -

You make the claim you are moving towards the winner's circle of this thing.

I've seen the pics of you on the motorcycle - doing absolutely amazing things.

You need to 100% believe in yourself and your work effort

You don't just go for the end trick - there is a progression, and you mastered all the them before going big.

You hit the trick - win the day, get paid.

what i'm getting at is you have confidence you can do this well - because you believe in you and the work you put in.

I'm sure you've had some nasty crashes - there is a recovery period to get back to where you were, and on you went.

Did you have a final crash where you didn't go back? Or were you able to walk away feeling topped out (ie age/time/family/cost)?

Are you applying this internal belief in yourself to day trading?

Believing you'll get there - and a couple crashes won't take you out?

I shouldn't just poo-poo it. If you are enjoying day trading and the mental challenge, then having a reasonable budget to hone skills, can't be questioned.

Just like any other serious hobby. Plenty of garages with $100k in bikes & parts in them. Biggest problem there is the depreciation.

you mentioned beating the market - what does that mean?

at the end of the year you are going to make 20% more than the market return? 100% more.

They are not going to have a favorable tax treatment. (I've stated before that I wish I paid $1MM in tax - but i'd rather it be on LTG)

Is it going to be just with your earmarked stash? or your whole portfolio?

Are you willing to make the big play ? not invest the last trade's earnings, but really go all in on something?

Like a casino, the play is against professionals with limitless money, and time.

If you don't walk out of the casino at some point, they will take it all.

When will you be a millionaire?

(I'm hoping you are soon)

The boring way - $100/wk @ market (10%) for 30 years will do it. 7 years later, it will be $2MM w/o additional contribution, 7 after that $4MM.

If you start at 22yo - at full retirement age it will be no problem pulling about $300K /yr w/social security.

Well we can't go backwards - so figure out where you are, what needs to be contributed. chatgpt can help with these types of calculations.

One last thing - anything successful will be modeled to take advantage of.

In other words, if you created a screener that you have 70% win rate, it will be found (cause that is what computers are really good at)

and the advantage will be lost.

Here is my world.

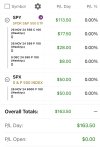

year to date my retirement investments are up 16% (no contributions) - SPX + high div stock + high div bond fund. 50/23/27 split.

Sure - it's easy in an up year. 8 year return is >10%/yr - mostly the same mix, where I moved some high div bonds to high div stocks.

That doesn't matter in an IRA - post tax account would be tax favored.

post tax money - half is in NJ tax exempt bond fund paying ~3.5%, some managed (they suck, but there is a reason - access to money is a stock-backed line of credit, similar to a HELOC), some in 4-5% savings/cd

I don't think about options, warrants, stops - i'm just boring (we know this)

It's in you to go big.

Oh

@Mahnken - takes a special person to do what you do. I think you mentioned that you do shift work now, rather than a regular schedule?

Are there connected industries that your experience would lend itself to? Teaching/training/tutoring. What about a specialty in-field? More appreciated usually means more $$.

-----------------------------------

In conclusion - every day, I/we have >90% of our money in the market. it doesn't miss dividend dates, it dollar-costs averages. It is already taking advantage of all the things the derivative market is analyzing, cause it is where the rubber meets the dirt. The market will not go to $0, options expire, individual stocks can be gutted - without a way to recover.

(I know you set up a trailing stop loss, but now you aren't in on the ones that do recover.)

Cruises seem to be making a comeback - check the momentum on NCLH

😉