No, he or she matched with money the company made, which she or he owns. Its their money, they don’t need to match the employee at all. It does benefit them to do so, by matching they are able to increase their pre-tax contributions to their retirement plan. i don’t see it as disproportionate, the employee gets a free contribution, that’s pretty sweet!in support of @THATmanMANNY

they set the "tone" - in NJ we are so accustom to seeing so many different nationalities.

gotta say, when i'm in missouri visiting my in-laws, they want to know about the eye-talian.

more than likely, @liong71er would have never been approached 8 years ago.

From a corporate standpoint, puppets? yes, they enact shit which enriches the wealthy - but it does

benefit those who participate - disproportionate as it may be.

Watch:

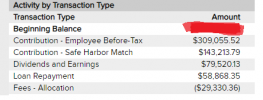

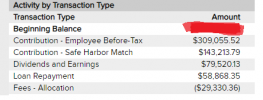

My company matches 1/3 of my contribution to my 401k up to 6%.

wow - what a wonderful thing. watch this

say i make $1,000/wk, so contribute 6% to get my max - i contribute a little more than $3k/yr and they match $1,000

owner makes $300k per year, and contributes 6% for 18,000 - and the company matches 1/3 - so they match $6,000.

What? They matched more than the $52,000/yr person contributed + matched!

It that a bad thing?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Biggest crash in stock market history?

- Thread starter Dave Taylor

- Start date

No, he or she matched with money the company made, which she or he owns. Its their money, they don’t need to match the employee at all. It does benefit them to do so, by matching they are able to increase their pre-tax contributions to their retirement plan. i don’t see it as disproportionate, the employee gets a free contribution, that’s pretty sweet!

in a single owner company, the plans are much different - this is more corporate, i shouldn't have used owner.

in a single owner/partnership/Sub-S corp, it is a SEP or SIMPLE. as the owner, you don't need to match anyone not working 3 of the last 5 years

and if they meet that test, they must receive a contribution in the same percentage as the owner (or class of worker - or something like that)

limits are much higher than 401k - 25% or $60k/yr

in a 401k, there are participation ratios which must be met - and if it is not, the match money can not be offered to anyone (or it is pro-rated)

yes, all about pre-tax, or extracting money from the company to get into the market - which pushes the market up.

the sp500 counts on it!

you don’t have to offer any contribution, right? It makes sense to do it, but you don’t have to have any plan, do you? But then you can’t take it, right ?in a single owner company, the plans are much different - this is more corporate, i shouldn't have used owner.

in a single owner/partnership/Sub-S corp, it is a SEP or SIMPLE. as the owner, you don't need to match anyone not working 3 of the last 5 years

and if they meet that test, they must receive a contribution in the same percentage as the owner (or class of worker - or something like that)

you don’t have to offer any contribution, right? It makes sense to do it, but you don’t have to have any plan, do you? But then you can’t take it, right ?

Contributions are not required - the catch is the owner might want to defer income.

It gets expensive quickly. but is a nice thing to do for employees. esp in high profit years.

Definitely, if you have the cash give it to the employees and yourself instead of the governmentContributions are not required - the catch is the owner might want to defer income.

It gets expensive quickly. but is a nice thing to do for employees. esp in high profit years.

Can we change the name of this thread to Worst stock market crash... and 401k plans.

I've been doing matching contributions for years. We have nearly a 75% participation rate and the employer contributions (me) get large pretty quickly. It's also a great opportunity for the ownership to take advantage to the safe-harbour regulations and maxamize our contributions.

I've been doing matching contributions for years. We have nearly a 75% participation rate and the employer contributions (me) get large pretty quickly. It's also a great opportunity for the ownership to take advantage to the safe-harbour regulations and maxamize our contributions.

THATmanMANNY

Well-Known Member

honestly, never do what the media and GS are pedaling. Do the opposite or somewhere in between.

So like I said up up and away!

So like I said up up and away!

Fire Lord Jim

Well-Known Member

Steering this thread back into the Biggest Crash in Stock Market History...

That will be the ideal time to do a Roth conversion. We can only do one Roth conversion per year. My strategy is to convert at the crash, or if we don't get the crash, to use it or lose it and convert in the last week of December. I did not think March was the big one, and so kept my powder dry. In hindsight, those who converted then, did well. I'm hoping we don't get the big one.

Prognosticators like to look to history to show why a crash in due, but I think they cherry pick the history. For example, people look to the post-war years at the tremendous economy, and never attribute it to the US dollar supplanting the Pound Sterling as the reserve currency. Once that occurred, government never again had to pay its bills with real money. Likewise today, the Federal Reserve is buying every dollar the Treasury can make believe it prints, and then Congress sprinkles helicopter money all over the economy (I dare not call it a market). So this game of musical chairs can continue so long as foreign central banks play the same tune. And if something bad happens, the Federal Reserve has shown that it is highly interventionist, and will be there to fix what breaks.

That noted, I am only 50% in equities. I need a lot of cash ready to pay the tax on that Roth conversion when the market crashes.

That will be the ideal time to do a Roth conversion. We can only do one Roth conversion per year. My strategy is to convert at the crash, or if we don't get the crash, to use it or lose it and convert in the last week of December. I did not think March was the big one, and so kept my powder dry. In hindsight, those who converted then, did well. I'm hoping we don't get the big one.

Prognosticators like to look to history to show why a crash in due, but I think they cherry pick the history. For example, people look to the post-war years at the tremendous economy, and never attribute it to the US dollar supplanting the Pound Sterling as the reserve currency. Once that occurred, government never again had to pay its bills with real money. Likewise today, the Federal Reserve is buying every dollar the Treasury can make believe it prints, and then Congress sprinkles helicopter money all over the economy (I dare not call it a market). So this game of musical chairs can continue so long as foreign central banks play the same tune. And if something bad happens, the Federal Reserve has shown that it is highly interventionist, and will be there to fix what breaks.

That noted, I am only 50% in equities. I need a lot of cash ready to pay the tax on that Roth conversion when the market crashes.

Steering this thread back into the Biggest Crash in Stock Market History...

That will be the ideal time to do a Roth conversion. We can only do one Roth conversion per year. My strategy is to convert at the crash, or if we don't get the crash, to use it or lose it and convert in the last week of December. I did not think March was the big one, and so kept my powder dry. In hindsight, those who converted then, did well. I'm hoping we don't get the big one.

Prognosticators like to look to history to show why a crash in due, but I think they cherry pick the history. For example, people look to the post-war years at the tremendous economy, and never attribute it to the US dollar supplanting the Pound Sterling as the reserve currency. Once that occurred, government never again had to pay its bills with real money. Likewise today, the Federal Reserve is buying every dollar the Treasury can make believe it prints, and then Congress sprinkles helicopter money all over the economy (I dare not call it a market). So this game of musical chairs can continue so long as foreign central banks play the same tune. And if something bad happens, the Federal Reserve has shown that it is highly interventionist, and will be there to fix what breaks.

That noted, I am only 50% in equities. I need a lot of cash ready to pay the tax on that Roth conversion when the market crashes.

Is it a paperwork thing, or do they actually require a sell/buy - which might take a couple days to clear?

I have a small IRA with an RMD, and they won't 'sell to cover' and drop the rest in the brokerage - they sell all, and deposit cash.

rick81721

Lothar

Can we change the name of this thread to Worst stock market crash... and 401k plans.

Yeah this thread started in March of this year with the question "Biggest crash in stock market history?": The answer is obvious - no!

Fire Lord Jim

Well-Known Member

That sounds like you have a proprietary fund and not transferable equities. Even at the broker where the fund is held, you could open a Roth there. Then, just transfer units / shares / investment from regular IRA to Roth, no sales, no cash, just tax.Is it a paperwork thing, or do they actually require a sell/buy - which might take a couple days to clear?

I have a small IRA with an RMD, and they won't 'sell to cover' and drop the rest in the brokerage - they sell all, and deposit cash.

I didn't think you were old enough for a RMD?

That sounds like you have a proprietary fund and not transferable equities. Even at the broker where the fund is held, you could open a Roth there. Then, just transfer units / shares / investment from regular IRA to Roth, no sales, no cash, just tax.

I didn't think you were old enough for a RMD?

Thanks for the info.

RMD for inherited IRA - prior to the new 5 year rule.

I’m debating doing a backdoor Roth on one of my accounts now. Just looking into the liability that could possibly come out of it.

remember the difference between tax avoidance and tax evasion is twenty years.

remember the difference between tax avoidance and tax evasion is twenty years.

Fire Lord Jim

Well-Known Member

Scaling the conversion is hard in that most people don't have enough cash to pay the income tax. That's why it is easier after a big crash. It is as though taxes are on sale. I usually try to just scale the conversion to use up the tax bracket I'm already in, without jumping to the next tax bracket, so long as it is less than I expect to face at RMD time.I’m debating doing a backdoor Roth on one of my accounts now. Just looking into the liability that could possibly come out of it.

remember the difference between tax avoidance and tax evasion is twenty years.

My only investing "regrets" are not investing enough early.S&P up 46% since the day this thread started. 🙂

I threw a little extra at the market in March. Very little extra but something. Was looking at finances last night because I'm looking to buy a house, saw those two march purchases and just thought "This house thing would be MUCH easier if those small investments were much larger..."

Our company 401K allows backdoor. However when I looked into it, it seemed so ridiculously complicated and easy to screw up, I decided not to bother. Most accountants seem to be unaware of it, and it's not a straightforward process. "Backdoor" seems to be a term the IRS doesn't actually use, which complicates things.I’m debating doing a backdoor Roth on one of my accounts now. Just looking into the liability that could possibly come out of it.

remember the difference between tax avoidance and tax evasion is twenty years.

Well, that and the need for the actual $$ to do it...

Fire Lord Jim

Well-Known Member

I think this is the universal regret. While I can't fix it for me, I can for the kids. They are old enough now to have just started working. For birthday, Xmas, etc., I fill their Roth IRAs. I think they will appreciate it when they turn 59½.My only investing "regrets" are not investing enough early.