YOLO, if these $2000 chdcks are really coming who cares about the fees. Fee away!A fee to process the original fee you paid.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tariffs...what to make of them.

- Thread starter Dave Taylor

- Start date

a.s.

Mr. Chainring

John the Plumber

Well-Known Member

It hasn't been a year yet.Highest budget deficit ever recorded last month

View attachment 272527

104billion in INTEREST alone...also a record

View attachment 272528

Long live DOGE!!!!

View attachment 272529

Ian F

Well-Known Member

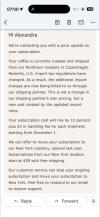

Ok... so depending on what the Euro-$ exchange rate is, that appears to be around a 25% tariff. Ouch.

a.s.

Mr. Chainring

More like 19% … plus UPS surcharges.Ok... so depending on what the Euro-$ exchange rate is, that appears to be around a 25% tariff. Ouch.

#winning

thegock

Well-Known Member

If you dont mind...I would love to know what you originally paid...at least that way, we can have some idea of the rate we will expect

I have an Illy pod espresso machine in my office.

Tuesday i got a notice from Amazon that there would be a price increase on a subscription.

Each canister of 21 pods in three discs of seven each inside a cylindracal tin. They had been priced around $18+/-. The new price in January would be $38.Of course the commodity price of coffee has been way up. I would guess the tariff is a component of the delta.

So I've got that going for me.

Last edited:

thegock

Well-Known Member

Ok... so depending on what the FX rate is...

Most of the population isn't aware of how the USD has depreciated versus the Euro in the past 10 months.

thegock

Well-Known Member

Steve Vai

Endurance Guy: Tolerates most of us.

Most of the population isn't aware of how the USD has depreciated versus the Euro in the past 10 months.

And they don't care as long as Mexicans can't use the unisex port-o-potty to read To Kill a Mockingbird.

Ian F

Well-Known Member

My calculation is based on the tariff only on the actual item, not the total purchase price. This is based on what I've filled out when shipping items overseas and filling out the USPS customs form. "Usually" the tariff is only on the declared value of the item being imported and does not include shipping costs.More like 19% … plus UPS surcharges.

#winning

a.s.

Mr. Chainring

We agree. It’s high and sucks.My calculation is based on the tariff only on the actual item, not the total purchase price. This is based on what I've filled out when shipping items overseas and filling out the USPS customs form. "Usually" the tariff is only on the declared value of the item being imported and does not include shipping costs.

Ian F

Well-Known Member

Definitely. I'm not planning to buy much until this all gets sorted out. There is still a reasonable chance the whole tariff thing gets ruled unconstitutional and then there will be a massive shit-show as they try to figure out how to refund everyone...We agree. It’s high and sucks.

Find a way to keep your receipts. You might get the tariff back... but the processing fee is probably gone forever... although I could imagine a class-action suite happening, which might get you some of it back.