Cassinonorth

Well-Known Member

How is that "stacked"? Both employees in your example get the same 100% match of their 5% of salary. What about the higher earner that makes 800K? Now their match is only 50% of their 5%.

The earner that makes $800k has access to things like the mega backdoor Roth IRA and all sorts of loopholes

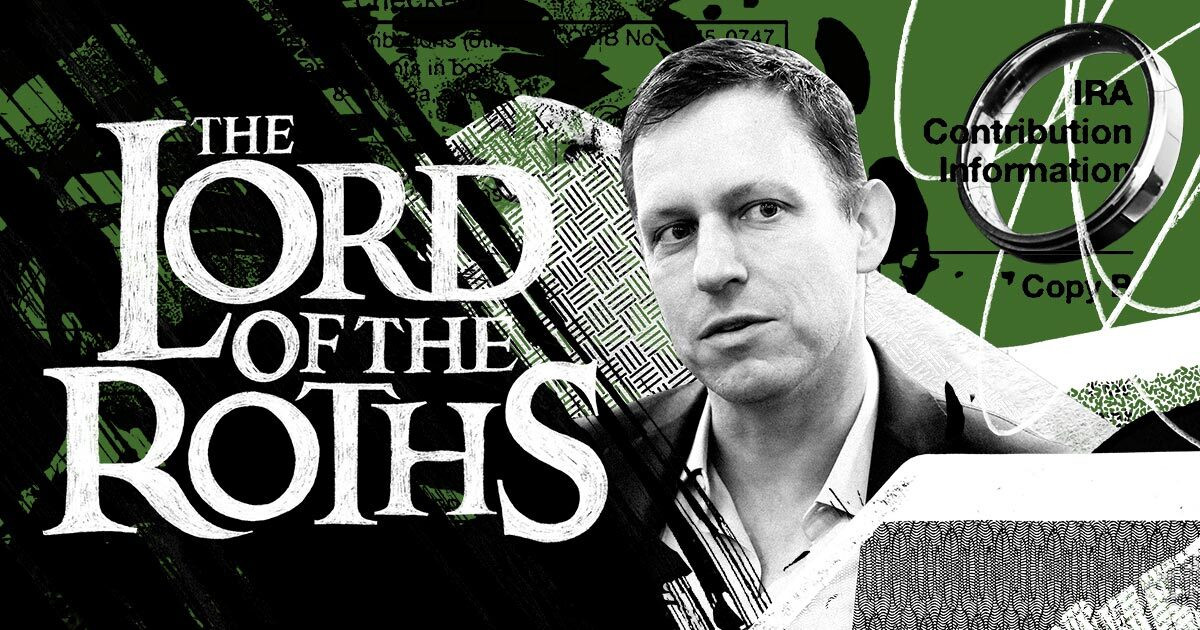

Lord of the Roths: How Tech Mogul Peter Thiel Turned a Retirement Account for the Middle Class Into a $5 Billion Tax-Free Piggy Bank

Roth IRAs were intended to help average working Americans save, but IRS records show Thiel and other ultrawealthy investors have used them to amass vast untaxed fortunes.